We share a common goal with you: helping people make charitable choices that best suit their wishes and their community. More and more professional advisors—such as lawyers, chartered accountants, financial planners, brokers and insurance agents—are turning to community foundations for advice and resources, and as a place to refer their clients to help inform or advise them on charitable giving in our community.

We can help you:

- Identify your client’s charitable giving interests and motivations

- Match personal charitable interests with tax planning needs

- Create and implement charitable plans that are integrated into major business, personal and financial decisions

- Facilitate complex forms of giving such as stock transfers

- Provide information on community needs — and on the local agencies and programs that make a difference in the areas your clients care about most

- Deliver grant-making expertise and a range of administrative services related to charitable giving

Complete Resource Guide for Advisors

Community Foundations of Canada has created an excellent PDF resource guide to help advisors add charitable planning to their practices.

Table of Contents:

- Talking about charitable giving

- Tools for professional advisors

- Six gifts options for Canadian donors

- How community foundations can help

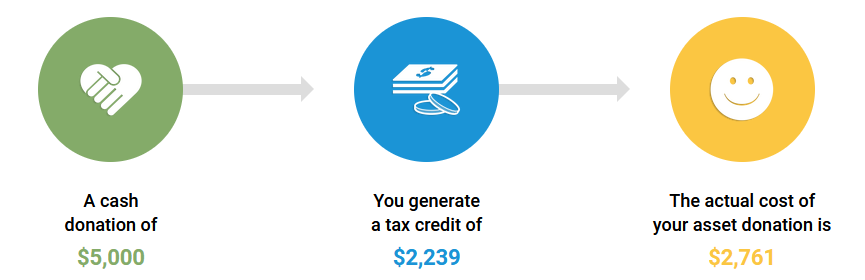

Donation Calculator

Plug numbers into this calculator to learn the tax benefits of a donation, based on your income and the amount you choose to give. You can also look at the power of your donation and the growth of your endowment over time.

Check out the Donation Calculator here. (Note: you will be taken to a 3rd party website that we have licensed.)

Introducing Giving

“Are there charitable or community needs you would like to consider?”

There is a good chance that your clients already have charitable intentions or commitments that are important to them. Giving back to the community is a very common sentiment and something worth exploring with your clients. Not only can you help them find significant tax savings, but, as their advisor, you can demonstrate your own commitment to the community and to ensuring that your clients have a comprehensive financial plan.

Charitable giving is simply part of the conversation you have with your clients.

Which charities should you recommend?

One of the most difficult questions clients ask there advisors is “which charities should I support”? With the Community Foundation as your partner, this question is easy to answer. We have indepth knowledge of the needs in the community and will work with you and your client to ensure the client’s charitable giving goals are achieved.

We are passionate about ensuring that the client’s goals are matched with the best plan for giving to the community, even if that means helping the client direct their giving to an organization other than the Community Foundation.

When to introduce charitable giving:

Situations arise with clients where the topic of charitable giving is simply a natural part of the conversation. These situations might include

- estate planning;

- writing or revising a will;

- sale of a business or other major asset;

- retirement planning; and

- marking a milestone

- substantial RRIF assets

In many of these situations, an opportunity exists to provide special service to your client through a discussion of planned giving. You don’t need to be the expert on charitable gift planning, or which charities to choose, to make these opportunities available. Working with other qualified professionals to answer those details, when necessary, is a very powerful way to serve your clients.

One of the simplest and most important things you can do to help your clients enjoy the benefits of giving is to ask them the giving question:

“Are there charitable or community needs you would like to consider?”

Why work with CFSOS?

Community foundations are a resource for advisors. Lawyers, chartered accountants, financial planners, brokers, insurance agents, and other professional advisors are turning to community foundations to help enrich the charitable giving strategies of their clients.

We can help you:

- Identify your clients’ charitable giving interests and motivations

- Match personal charitable interests with tax planning needs

- Create and implement charitable plans that are integrated into major business, personal and financial decisions

- Facilitate complex forms of giving such as stock transfers

- Provide information on community needs — and on the local agencies and programs that make a difference in the areas your clients care about most

- Deliver grant-making expertise and a range of administrative services related to charitable giving

Ways to give

A variety of giving methods tailored to your unique situation.

One of the benefits of a Community Foundation is the flexibility with which we can accept your generosity. All of the options below are acceptable, but we advise that you speak with your Professional Advisor for to ensure you use the method that makes the most sense for your financial situation. In some cases, the benefit of your gift can increase dramatically by implementing the appropriate giving strategy.

Outright Gift

You can make a gift of cash, stocks, bonds, real estate, or other assets to your community foundation. Your gift qualifies for maximum charitable benefit under federal law.

Appreciated Securities

You can give appreciated securities to the Community Foundation to eliminate capital gains tax and get an immediate tax receipt for the market value of those securities.

Bequest

You can designate a gift or portion of your estate to the Community Foundation and, in some cases, receive a substantial reduction in federal gift and estate taxes.

Charitable Remainder Trust

You can place cash or property in a trust that pays annual income to you (or another named beneficiary) for life. After your death, the remainder of the trust transfers to the Community Foundation, and is placed in a charitable fund you’ve selected. You receive income tax benefits the year you establish your trust.

Creating a Fund with the Foundation

Setting up a fund with the Community Foundation of the South Okanagan | Similkameen is very simple and can be done in several ways. If your client is making an immediate gift to the Community Foundation then it is best for us to meet with them in person at some point in the planning process.

If your client has designated the Community Foundation of the South Okanagan | Similkameen as a beneficiary in a will then they may forego meeting with us to establish a fund agreement. However, whenever possible, we still prefer to meet with the client to ensure we honour their intentions for the gift.

Steps in Creating a Fund

1. Discussion

The initial discussion with the client will explore questions surrounding their specific philanthropic wishes. We will determine the purpose of the gift, the type and amount of the gift, the name of the fund, the amount of ongoing involvement the donor wishes to have, and the type of recognition the donor wishes to receive.

Once these basic questions are answered, we will draw up a draft fund agreement for review.

2. Gift Amounts

The donor will be apprised of the gifting rules for each type of fund. Certain fund types have minimum donation amounts before the fund can be established. However, the client will always have the option of creating an “emerging fund”, which allows them to build up to the minimum fund amount over time.

Note that there is no minimum donation if the client wishes to donate to an existing “open fund”.

3. Documentation to Establish a Fund

The Community Foundation of the South Okanagan | Similkameen enters into a written agreement with each donor intending to establish a permanent endowment fund. This agreement sets out the purpose of the fund, the responsibilities of the Foundation and any specific requirements relative to the particular fund. The wording has been designed to meet the Canada Revenue Agency’s requirements for charitable giving. Copies of this agreement are provided to the client (and the advisor if appropriate.)

Regardless of the type of gift (during their lifetime or on death), donors can be assured that their goals will be carried out forever.

While most gifts by bequest are received without an existing contract in place, it is preferable that the Community Foundation have the opportunity to complete paperwork with the donor while they are still alive. This is important for several reasons:

- Meeting the donor and drawing up an agreement ensures that the Foundation fully understands the donors wishes.

- Specifying the beneficiaries of the Fund in the Fund agreement allows for the donor to amend the agreement at little or no cost compared to amending the beneficiaries in a will.

Bequest Language

The Community Foundation would be pleased to assist you with the process of refining giving language in your will, even if you prefer to give to a different charity. Our mission is to increase the level of giving in our region and we know that one reason people don’t give is because the questions seem too challenging to answer.

When considering a gift to charity in your estate, it is important to make sure that the language in your will:

- accurately reflects your wishes

- clearly and accurately identifies the charities you wish to support

There are some common pitfalls associated with gifts to charity that should be considered:

- Is the name of the charity accurate?

- What happens if the charity doesn’t exist when you die?

- Do you want to provide specific instructions for your gift? For example, is the gift to be used only for a capital project? Is it to be endowed? Or do you want to allow the charity to make the best investment of your gift at the time?